A Lower Bound of China's Real Estate Price

Real estate price is an important economic indicator. It has crucial implications in Japan’s economic bubble from 1986 to 1991 and the 2008 global financial crisis.

Then, in the last decades, China’s real estate price rocketed, which is similar to what has previously happened in Japan. Many economists believe that there are bubbles in the price, but they cannot give solid proof.

In this post, I will estimate the lower bound of current China’s real estate price. This estimation is based on the recent campaign of Evergrande, one of the largest real estate developers in China.

Evergrande’s campaign

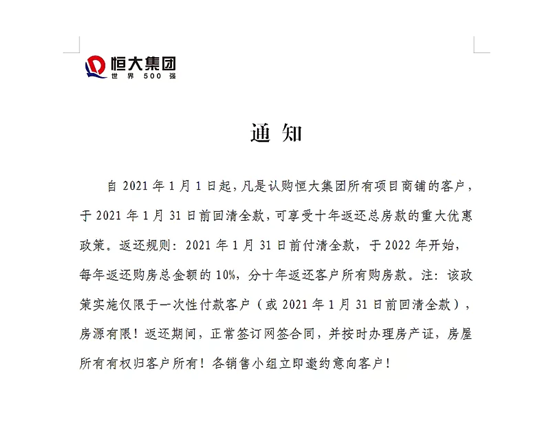

On January 4, 2021, An ongoing campaign of Evergrande captured the attention of Chinese netizens. The campaign announced that if the client bought a commercial property at full price (i.e., no mortgage), he would be fully refunded during a 10-year period (10% per year). In other words, the client gets a commercial property “for free”.

Of course, Evergrande is not a charity: by no means would it send out money for free. The trick is that the previous calculation neglects the time value of money. That is, 100 dollars now are of more utility than 10 dollars per year for the next ten years. The utility difference is refunded with the property.

Evergrande’s innovation

This campaign can be regarded as a financial innovation of Evergrande. They use the commercial properties on sale as a financing tool to borrow money from the market. This tool has two differences from the traditional financing tools such as corporate bonds.

Firstly, this commercial property is not collateral. In a traditional corporate bond, the company may use some assets as collateral (to lower the borrowing interest rate). If the company manages to pay the interest and repay the principal, they can get the collateral back. Otherwise, the collateral will be sold to refund the investors. In Evergrande’s campaign, the asset known as the commercial property, however, is not collateral. It is given to the client no matter whether Evergrande defaults.

Secondly, the financing source is not the investors in the financial market but the consumers in the retail market. Traditionally, companies issue bonds through public offering or private placement; in either case, the audience is registered investors, who either have an account in the financial market or are investment management companies. In Evergrande’s campaign, the audience is, however, anyone in the retail market; there is no entry barrier.

Despite these two differences, this innovation of Evergrande is still a fixed-income financial product. With classic pricing methods, we can obtain its yield to maturity, which is of course a function of the commercial property’s value, which is unknown.

On the other hand, the yield to maturity can also be obtained through Evergrande’s outstanding corporate bonds, whose value is known. By equating these two yields to maturity, we can then get the value of the commercial property. But before we equate these two yields to maturity, we need first to answer the question: why can we equate them?

Law of one price

To answer this question, let me introduce you to the law of one price. It claims that the same product or service should have the same price in different markets. Otherwise, there would be arbitrage opportunities. That is, you can buy the product at a lower price in one market and sell it at a higher price in the other market, and this transaction should be of no risk.

In practice, the law of one price does not meticulously hold. For instance, MacDonald’s burger price in the US is not the same as in China. This inequality is due to the impracticality of transporting cooked burgers across continents.

Although the law of one price does not precisely hold, the reality should not be too far away from this principle. The farther the prices deviate from this law, the stronger the motivation is to arbitrage, which in turn closes this price gap.

In terms of Evergrande’s innovation, the two yields to maturity (the prices of money) should be quite close. If it is not the case, say, the yield to maturity in the retail market is much higher than the one in the financial market (bond), the arbitrators will sell short Evergrande’s bonds, use the cash obtained to buy the commercial property, sell the property, and use the cash obtained as well as the pending principal repayment to buy back Evergrande’s bonds. On the other hand, if the yield to maturity in the retail market is lower than the one in the financial market, no one will participate in this campaign.

Therefore, it is reasonable to assume that the financing cost from the investors in the financial market is equal to the financing cost from the consumers in the retail market. The two yields to maturity are equal.

Yield to maturity in the financial market

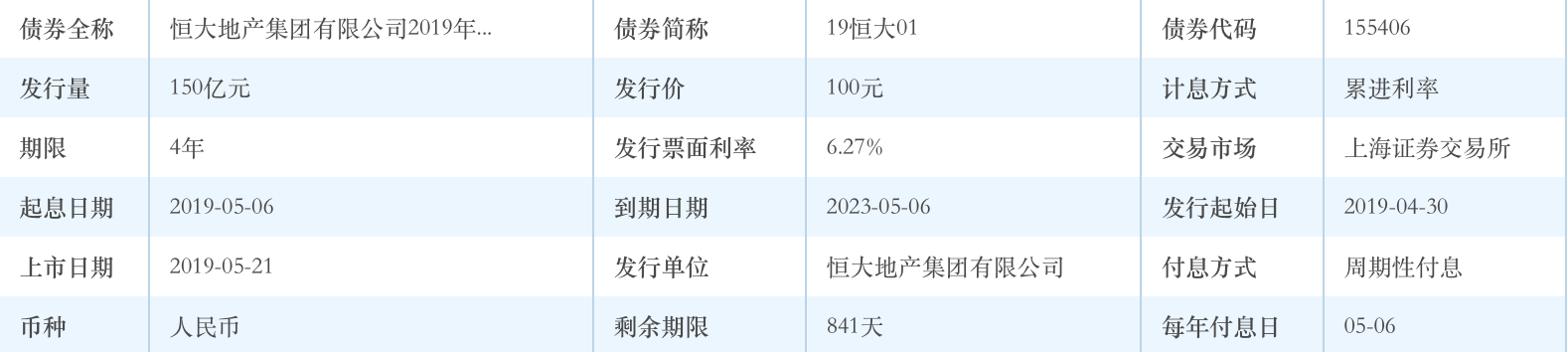

The yield to maturity in the financial market can be calculated from Evergrande’s most recent publicly listed bond (155406), whose price was approximately 90.

This price should be the flat price, which does not include the accrued interest. The coupon rate is 6.27%. The bond is currently one year into a four-year term.

So we can express the cash flow in the following plot.

The yield to maturity is the $r$ satisfying the following equation: [ 90 = \frac{6.27}{(1+r)} + \frac{6.27}{(1+r)^2} + \frac{106.27}{(1+r)^3}. ] The value of $r$ is approximately 10%.

Yield to maturity in the retail market

Similarly, we can express the cash flow concerning Evergrande’s campaign:

The unknown $x$ stands for the true value of the commercial property per 100 dollars.

The yield to maturity is the $r$ satifying the following equation: [ 100 = x + \sum_{i=1}^{10} \frac{10}{(1+r)^i} ]

Let $r$ be 10%, the value from the previous section, we get $x \approx 40$.

In other words, the commercial price is worth only 40% of its current market price. A huge bubble exists.

Discussion

The 40% calculated from the previous section should be regarded as the lower bound of commercial properties’ value. Judging from the high solvency risk of Evergrande, they likely undersold their properties, which makes the true property value higher than is implied by the campaign.

Also, this calculation above concerns only commercial properties, not residential properties. Generally, the prices of residential properties are more resilient than their commercial counterpart. Therefore, the lower bound for the commercial properties should also be the lower bound for the residential properties, and thus for properties overall.

Finally, this research has a few limitations:

-

I relied on the law of one price, which may not hold in practice. If the yield to maturity in the retail market is significantly higher than in the financial market, my calculation will underestimate the lower bound. That is, the lower bound thus calculated is not tight.

-

I ignored the term structure of interest rates. Evergrande’s bonds have a term of 4 years, whereas the campaign forms a fixed-income product with a term of 10 years. In general, longer-term interest rates should be higher than short-term interest rates. Thus, I again underestimated the lower bound.

-

I considered Evergrande only, which is just one real estate developer in China. The price is, however, determined by all supplies and demands in the market. My estimation is based on a small sample.

-

I did not consider the gain from the lease of the commercial property. This is reasonable because the value of the property should already contain the potential lease gain.

Conclusion

The lower bound of China’s real estate price is calculated to be 40% of its current price, which means that the bubble in the price can be as high as 60%.